Forex Daily Analysis for EURUSD and GBPUSD

Analysis for EURUSD

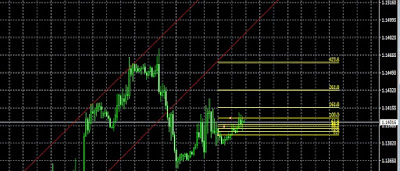

EUR/USD keeps riding nearby the uptrend bolster channel that goes with it since mid-November. Clutching a rising line suggests further increases ahead.

Obstruction anticipates at 1.1430 that topped the combine not long ago. It likewise corresponds with the 200 Simple Moving Average on the four-hour outline. Further up, 1.1480 was the pinnacle of the week. Close by, 1.1510 is the November high, seen from the get-go in the month.

1.1390 remains a fight line. It upheld EUR/USD a week ago and furthermore in the primary seven day stretch of November. 1.1355 was the low purpose of the week. 1.1305 is a round number and filled in as twofold base. 1.1210 is the least dimension recorded in 2018.

The match is up for one more session around the 1.1405 handle and constantly cautious on advancements from Italy and the Brexit arrangements, all in the midst of thin exchange conditions and rare instability because of the Thanksgiving Day occasion in the US markets.

Actually, the political circumstance in Italy continues rotating around the 2019 draft spending plan and the potential assents against the nation from the European Commission, the supposed 'inordinate deficiency system'.

Meanwhile, vulnerability around Brexit stays high while everyone's eyes stay upon PM T.May's visit to Brussels to talk about the arrangement later today.

Information astute in Euroland, the ECB will distribute its minutes from the most recent gathering and the European Commission will discharge the blaze perusing of the Consumer Confidence for the present month.

Analysis for GBPUSD

Indeed, even from a specialized point of view, the match on Wednesday was not able support over the 1.2800 handle and confronted dismissal at 100-hour SMA. The value activity unmistakably indicates winning offering inclination at larger amounts and consequently, any up-move back over the 1.2810 handle may keep on standing up to some crisp supply close to the 1.2830 area.

Be that as it may, a persuading leap forward the made reference to boundary may trigger a short-covering bob and lift the match towards the 1.2880 middle of the road opposition in transit the 1.2910 handle. Any resulting quality appears to probably fail out and stay topped close to the 1.2950 locale.

On the other side, the 1.2770-55 area may keep on ensuring the quick drawback, which whenever broken may turn the match defenseless against quicken the fall towards the 1.2710 handle before in the end dropping to retest YTD lows, around the 1.2665.

Know more Free Forex Signals https://www.thebestforexsignal.com/forex-news-2018-11-22-forex-daily-analysis-for-eurusd-gbpusd.html

EUR/USD keeps riding nearby the uptrend bolster channel that goes with it since mid-November. Clutching a rising line suggests further increases ahead.

Obstruction anticipates at 1.1430 that topped the combine not long ago. It likewise corresponds with the 200 Simple Moving Average on the four-hour outline. Further up, 1.1480 was the pinnacle of the week. Close by, 1.1510 is the November high, seen from the get-go in the month.

1.1390 remains a fight line. It upheld EUR/USD a week ago and furthermore in the primary seven day stretch of November. 1.1355 was the low purpose of the week. 1.1305 is a round number and filled in as twofold base. 1.1210 is the least dimension recorded in 2018.

The match is up for one more session around the 1.1405 handle and constantly cautious on advancements from Italy and the Brexit arrangements, all in the midst of thin exchange conditions and rare instability because of the Thanksgiving Day occasion in the US markets.

Actually, the political circumstance in Italy continues rotating around the 2019 draft spending plan and the potential assents against the nation from the European Commission, the supposed 'inordinate deficiency system'.

Meanwhile, vulnerability around Brexit stays high while everyone's eyes stay upon PM T.May's visit to Brussels to talk about the arrangement later today.

Information astute in Euroland, the ECB will distribute its minutes from the most recent gathering and the European Commission will discharge the blaze perusing of the Consumer Confidence for the present month.

Analysis for GBPUSD

Indeed, even from a specialized point of view, the match on Wednesday was not able support over the 1.2800 handle and confronted dismissal at 100-hour SMA. The value activity unmistakably indicates winning offering inclination at larger amounts and consequently, any up-move back over the 1.2810 handle may keep on standing up to some crisp supply close to the 1.2830 area.

Be that as it may, a persuading leap forward the made reference to boundary may trigger a short-covering bob and lift the match towards the 1.2880 middle of the road opposition in transit the 1.2910 handle. Any resulting quality appears to probably fail out and stay topped close to the 1.2950 locale.

On the other side, the 1.2770-55 area may keep on ensuring the quick drawback, which whenever broken may turn the match defenseless against quicken the fall towards the 1.2710 handle before in the end dropping to retest YTD lows, around the 1.2665.

Know more Free Forex Signals https://www.thebestforexsignal.com/forex-news-2018-11-22-forex-daily-analysis-for-eurusd-gbpusd.html

Comments

Post a Comment